Taking Stock in Affinities and Market Performance

If you haven’t checked your 401(k) or IRA in the last month, you are probably going to discover some dramatic ups and downs, as the markets first reacted to the weight of world events, and then rebounded on the strength of the economic recovery. Of course, the market is no stranger to volatility. Take a look at Facebook, Inc. (FB) in 2012: on its first day of trading, it was reported that the underwriters, people backing the investment, struggled to keep its price above the opening price of $38, and within weeks, it experienced significant decline. Today, it trades near record highs.

When we are not helping our clients extend their reach, we at Affinity Answers spend time understanding which aspects of consumer behavior are reflected in what they do on social media, and how broadly this can be applied. Our previous blog posts on the fall TV season and botched celebrity endorsement deals show that there is some correlation. Establishing a link between IPOs and social affinities is just as significant as it will show that activity on social media is reflective of a much smaller subset of the population: investors.

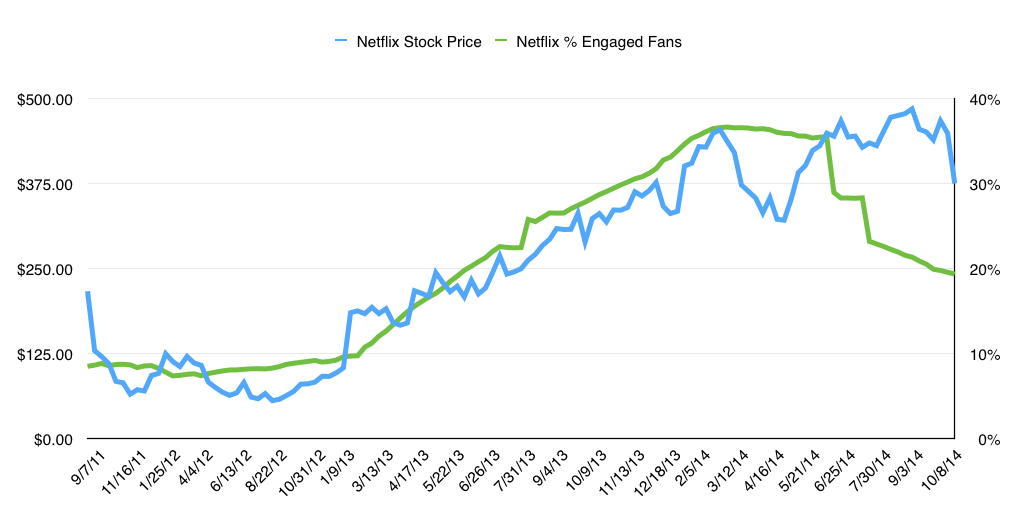

Let’s begin by reviewing a brand that has evolved from just another rental service to a verb we use when streaming a movie or TV show: Netflix. It also happens to be the brand with the highest engagement rate – defined by users having done one or more activities, such as hashtagging or photo posting, in the past year – so it’s an ideal brand to compare to investor behavior. And it’s with this brand that we can really establish a case for linking investor behavior to social engagement behavior. In fact, as you can see in the graph below, social media engagement for Netflix has an 84% correlation with its stock price over a 3-plus-year period.

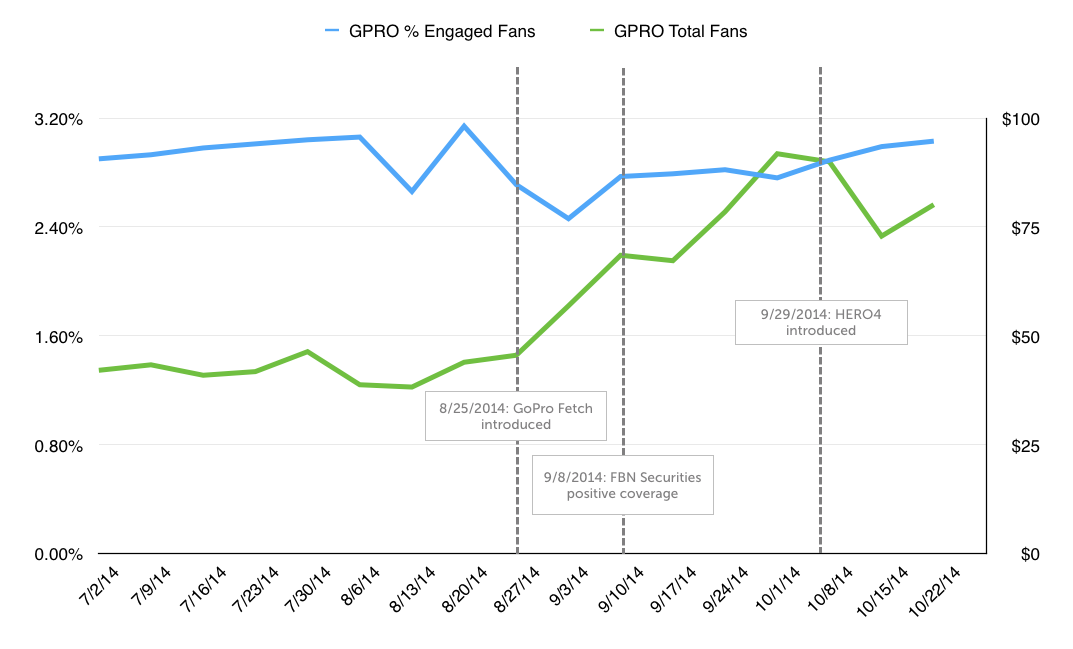

While the Netflix example is great because of its history, we can also find another in one of 2014’s high profile IPOs: GoPro, Inc. (GPRO). The San Mateo, CA-based wearable camera company made its public trading debut on June 26, and its performance seems to have the makings of investor enthusiasm outpacing consumer engagement.

GoPro’s growth in engaged fans tracks well with the closing stock price through August, but after that, the two metrics pull away from one another. There has been much speculation around this: optimism about prospects for the holiday season, the release of new products in September and October and the possibilities of expanding its owned media channels. While some analysts believe that this leaves the company nowhere to go but down, it’s clear that valuation, based on what GoPro could be, has far outpaced social engagement, which points to what the brand is to consumers today. FBN Securities’ coverage of all the positive attributes the brand has going for it led to a temporary pop in engaged fans; by contrast, the stock continued to rise.

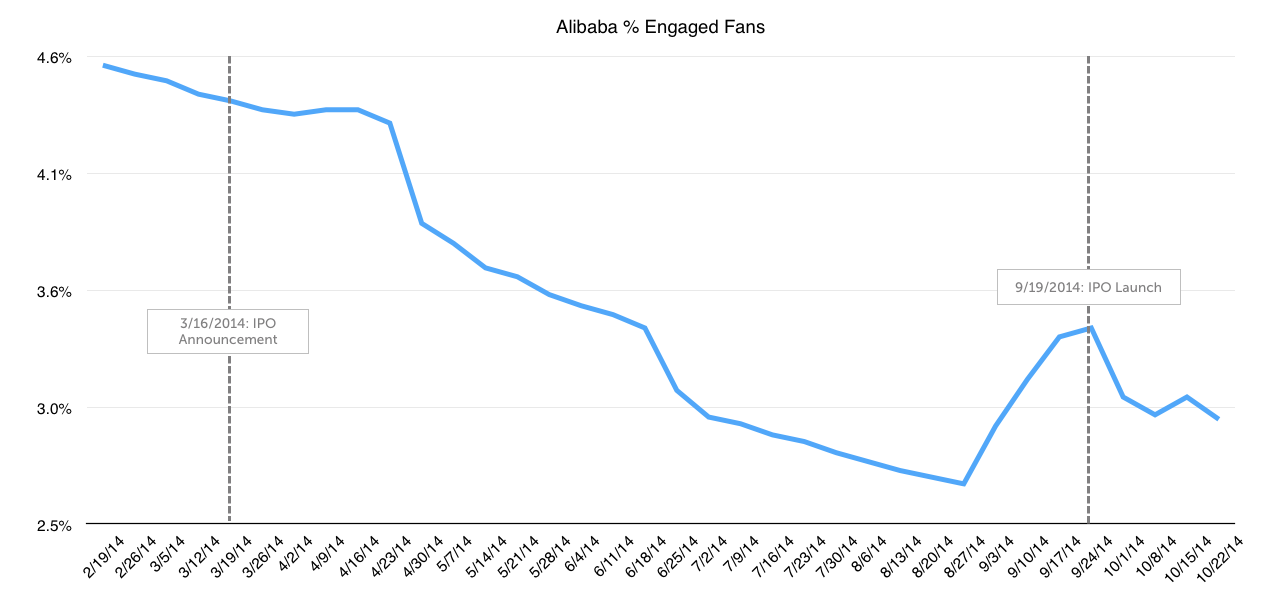

Finally, let’s conclude by reviewing the most recent widely anticipated IPO: Alibaba Group (BABA). It is China’s largest online commerce company, and following its going public, one of the most valuable tech companies in the world. Because of its recent IPO, Alibaba allows us to see how just the mention of an IPO temporarily inspires social engagement, but also demonstrate how it is short lived.

Since engagement on social media requires action on the part of the user, it’s much more of an apples-apples comparison to trading stocks. With that in mind, you can see that the normal decline in percentage of engaged fans is slowed around the time of the IPO announcement. More significant is the steep increase in the week leading up to the IPO launch – a 12% gain over the previous four weeks’ average – followed by an equal decline in the weeks since the stock began trading.

The key takeaway from all of these examples is that while stock price is correlated to social engagement, the former often takes on a life of its own. While many more type of stocks, across different type of industries Investors are looking for value in the future, while consumers are looking for relevance in their lives today. Investors reflect an important, but small, portion of the consumer base, but affinities give the complete picture of your brand’s value to the world.

How will you use affinities data to assess your brand’s true value?